Understanding PrimeXBT Risk Disclosure Essential Insights for Traders

Understanding PrimeXBT Risk Disclosure

Before diving into the exciting world of cryptocurrency trading, it is crucial to understand the potential risks involved. This is where PrimeXBT Risk Disclosure Risk Açıklaması PrimeXBT comes into play. As a trader, being informed about risks is not merely a formality but a necessity for long-term success.

What is PrimeXBT?

PrimeXBT is a cryptocurrency trading platform that allows users to trade a variety of digital assets. Founded in 2018, it has grown rapidly due to its user-friendly interface, advanced trading tools, and a wide array of supported cryptocurrencies. The platform stands out for offering leverage trading, enabling traders to maximize their potential profits while also accentuating the risks involved.

Understanding the Risks

Trading cryptocurrencies can be highly rewarding, but it also carries significant risk. Understanding and managing these risks is essential for traders. Below are the key risks associated with trading on PrimeXBT and other similar platforms:

1. Market Risk

Market risk refers to the potential financial loss due to adverse price movement of assets. Cryptocurrencies are notoriously volatile, and prices can swing dramatically within a short period. This volatility can lead to substantial profits but can also result in significant losses. Traders must be prepared for sudden market movements and have a solid strategy to manage risk.

2. Leverage Risk

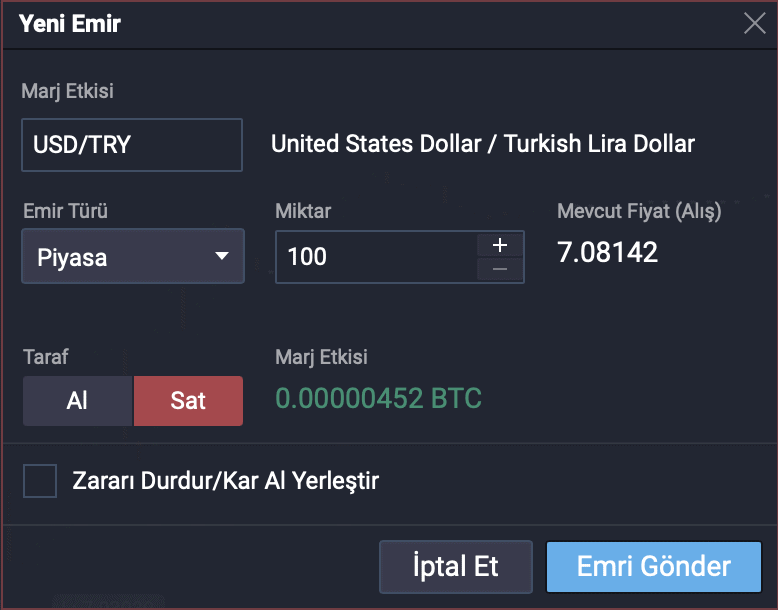

While leverage can amplify profits, it equally magnifies potential losses. PrimeXBT offers up to 100x leverage, which means that traders can control a larger position with a smaller amount of capital. However, trading with high leverage increases the risk of a margin call or liquidation if the market moves against the trader’s position. Understanding how leverage works and using it judiciously is paramount.

3. Liquidity Risk

Liquidity risk occurs when traders are unable to buy or sell an asset quickly enough to prevent a loss. In less volatile markets, liquidity might be stable. However, crypto markets can experience sudden dips in liquidity, making it challenging to execute trades at desirable prices. Traders must be mindful of liquidity and consider it when placing trades, especially in times of high volatility.

4. Regulatory Risk

The regulatory landscape for cryptocurrencies is constantly evolving. Governments around the world are implementing regulations that can impact trading practices. These changes can lead to unexpected disruptions in service or changes in trading conditions. Traders should stay informed about regulatory developments in their jurisdiction to avoid legal complications.

5. Technology Risk

Trading platforms like PrimeXBT rely on technology, which comes with its own risks. System outages, server downtimes, and cyberattacks can hinder a trader’s ability to execute trades. Therefore, it is critical to ensure that the platform you are using possesses high-security standards and a reliable infrastructure to minimize potential technology-related losses.

Mitigating Risks

While risks are inherent in trading, there are several strategies traders can employ to mitigate them:

1. Educate Yourself

Knowledge is the most powerful tool for a trader. Understanding the market, trading strategies, and the various risks involved can help traders make informed decisions. Engaging with educational resources, attending webinars, and following market analyses can enhance a trader’s ability to navigate the crypto landscape.

2. Use Stop-Loss Orders

Stop-loss orders are designed to limit potential losses on a position by automatically selling an asset when it reaches a specified price. Utilizing stop-loss orders can help traders manage their risk and protect their capital, particularly in volatile markets.

3. Diversification

Diversifying a portfolio can reduce overall risk. Traders should consider spreading their investments across multiple cryptocurrencies or asset classes to minimize exposure to any single asset. This strategy can help mitigate losses if one asset performs poorly.

4. Start Small and Scale Up

For those new to trading or the PrimeXBT platform, starting with smaller trades can help build confidence and experience without risking too much capital. As traders become more familiar with market dynamics and improve their skills, they can gradually increase their position sizes.

5. Regularly Review Your Strategy

Markets are dynamic, and strategies should be continuously evaluated and adjusted according to changing market conditions. Regularly reviewing one’s trading strategy can help identify weaknesses and capitalize on strengths, ensuring that a trader remains competitive in the market.

Conclusion

Understanding PrimeXBT Risk Disclosure is not just about recognizing what’s at stake in terms of potential profits and losses. It’s about cultivating a culture of awareness and diligence that can lead to better decision-making. By taking the time to understand the risks associated with trading and implementing effective risk management strategies, traders can enhance their chances of success in the ever-evolving world of cryptocurrency.

Embrace the challenges of trading with a proactive mindset, stay informed, and approach the markets with respect and caution. In doing so, you’ll be on the path toward a more rewarding trading experience on platforms like PrimeXBT.

Share your comment :